WORK OPPORTUNITY TAX CREDIT

The Work Opportunity Tax Credit (WOTC) is a federal income tax credit designed to encourage employers to hire individuals with historically high rates of unemployment. Employers claim about $1 billion in tax credits each year under the WOTC program. WOTC helps targeted workers move from economic dependency into self-sufficiency, while participating employers are able to reduce their federal income tax liability. On December 18, 2015, President Obama signed into law the Protecting Americans from Tax Hikes Act of 2015 (the PATH Act) that extends and modifies the WOTC Program and the Empowerment Zone with the following changes:

- Retroactively reauthorizes the WOTC program target groups for a five-year period, from December 31, 2014 to December 31, 2019.

- Extends the Empowerment Zones for a two-year period, from December 31, 2014 to December 31, 2016.

- Introduces a new target group, Qualified Long-term Unemployment Recipients, for new hires that begin to work for an employer on or after January 1, 2016 through December 31, 2019.

WHO QUALIFIES?

Employers can hire eligible employees from the following target groups:

- • Unemployed Veterans (including disabled veterans)

- • Temporary Assistance for Needy Families (TANF) Recipients

- • Food Stamp (SNAP) Recipients

- • Designated Community Residents (living in Empowerment Zones or Rural Renewal Counties)

- • Vocational Rehabilitation Referred Individuals

- • Ex-Felons

- • Supplemental Security Income Recipients

- • Summer Youth Employees (living in Empowerment Zones)

THE VALUE OF WOTC

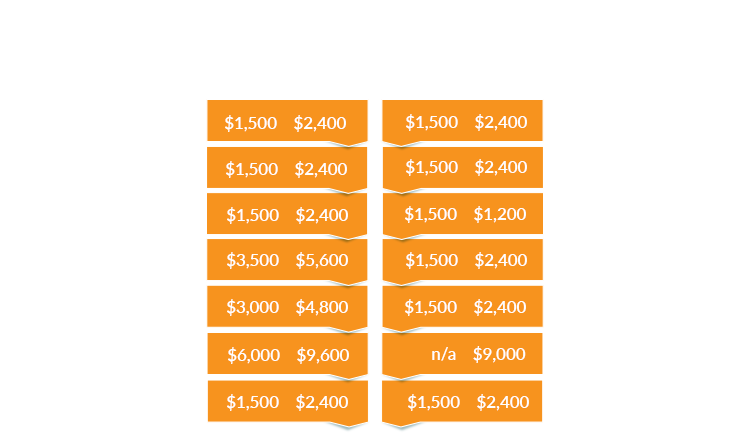

Participating employers can earn a tax credit of between $1,200 and $9,600 per employee, depending on the target group of the new employee and the number of hours worked in the first year. Employers generally can earn a tax credit equal to 25% or 40% of a new employee’s first-year wages, up to the maximum for the target group to which the employee belongs. Employers will earn 25% if the employee works at least 120 hours and 40% if the employee works at least 400 hours.

EXAMPLES OF BENEFITS

• 200 New Hires, Food & Beverage Industry (13% Net Cert), ($800 Avg. Credit) = $20,800

• 1500 New Hires, Manufacturing Industry (8% Net Cert), ($1600 Avg. Credit) = $192,000

• 25000 New Hires, Retail (9% Net Cert), ($1200 Avg. Credit) = $2.7M