IC-DISC

IC-DISC is a tax incentive for manufacturers, producers, resellers, and exporters of goods that are produced in the United States. In order to reduce taxable income, companies can create an interest charge domestic international sales corporation (IC-DISC), a separate corporation that acts as a sales commission agent. Based on their foreign sales, exporters pays a commission to the IC-DISC and then deduct the commission from their ordinary business income, resulting in a deduction at ordinary tax rates. The IC-DISC receives the commission without having to pay federal tax on the income.

WHO IS ELIGIBLE?

Any entity (including C corporations, S corporations, partnerships, LLCs, and sole proprietors) that sells “export property” and are profitable can benefit from using an IC-DISC. Sec. 993(c) defines export property as property:

- That is manufactured, produced, grown, or extracted in the United States;

- That is then held for sale, lease, or rental for direct use, consumption, or disposition outside the United States; and

- The fair market value of which is not more than 50% attributable to articles imported into the United States.

Qualified candidates include:

- Companies that directly export goods they manufacture

- Companies that provide architectural or engineering services that are conducted in the U.S. for a building/bridge built outside of the U.S

- Companies that manufacture a good that is included in a product that is exported are all eligible candidates

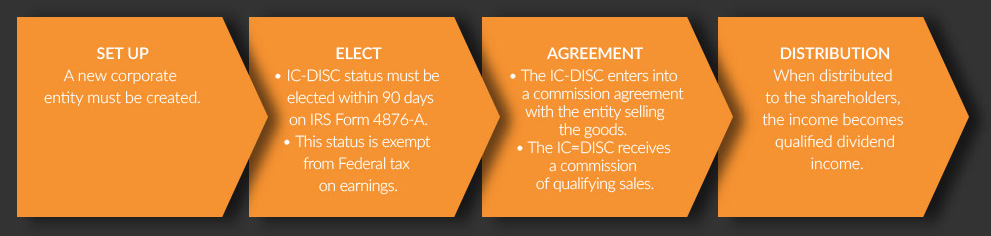

IC-DISC PROCESS