MANUFACTURING RESEARCH & DEVELOPMENT TAX CREDIT

- Aerospace Manufacturing

- Apparel and Textiles Manufacturing

- Automotive Parts Manufacturing

- Building Systems Control Manufacturing

- Chemical Manufacturing

- Electronics Manufacturing

- Firearms & Ammunition Manufacturing

- Medical Equipment Manufacturing

- Food & Consumer Packaged Goods Manufacturing

- Foundries

- Job Shops

- Life Sciences

- Metals

- Oil & Gas

- Plastics Manufacturing

- Telecommunications

- Tool & Die Manufacturing

- And More

Maximizing your opportunity for success

A significant portion of R&D tax credits are given to the manufacturing industry. But the diversity of manufacturing segments makes it difficult to determine whether R&D tax credits are applicable. All manufacturers should discuss their business with an R&D tax specialist such as Apex Advisors.

EXAMPLES OF QUALIFYING MANUFACTURING ACTIVITIES INCLUDE

- Manufacturing products

- Developing new, improved or more reliable products/processes/formulas

- Designing tools, jigs, molds and dies

- Developing prototypes, models, and samples (including computer generated models)

- Developing patents

- Adding new equipment (labor and engineering cost aspects)

- Testing new concepts and technology

- Attempting the new use of materials and compounds

- Performing testing

- Developing, implementing or upgrading systems and/or software

- Performing environmental testing

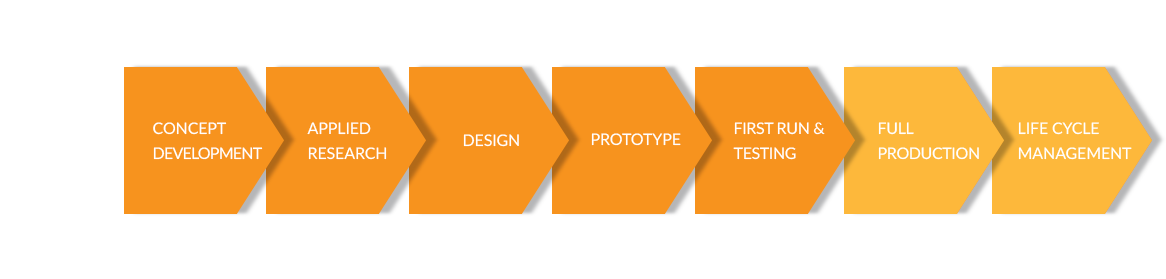

FROM CONCEPT TO PRODUCTION

R&D TAX CREDITS IN THE MANUFACTURING INDUSTRY

R&D tax credits are concerned with activities, not just allocated R&D budgets. Qualified R&D activities generally start at the point of initial product development and continue through testing. Once a product has been finalized and put into production, R&D no longer applies.

Manufacturing

Many manufacturing and distribution firms are not aware that the government has enacted tax changes that help them recover cash based on activities that most consider day-today operations. Efforts made to design and develop products and manufacturing processes for optimal performance and efficiency can entitle a company in the manufacturing industry to generous research and development tax credits.

Client A

- Employees: 51

- Revenue: $7,326,000

- Total Credit: $53,000 **

Client B

- Employees: 190

- Revenue: $15,913,000

- Total Credit: $166,000 **

Client C

- Employees: 279

- Revenue: $74,006,000

- Total Credit: $280,000 **

Federal Only (*) or Federal & State (**)

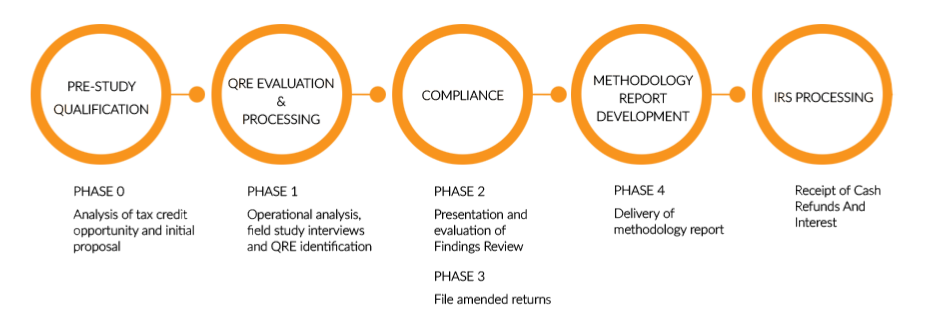

THE APEX ADVISORS R&D TAX CREDIT PROCESS

From study to processing

We utilize a comprehensive process that ensures all possible R&D activities are considered and calculated with accuracy. The Preliminary Assessment is provided to companies at no cost. The estimated duration of all phases is 2 to 3 months.