SOFTWARE RESEARCH & DEVELOPMENT TAX CREDIT

- Accounting and Financial Software

- Document Management Systems

- Content Management Software

- Enterprise Infrastructure Software

- Claims Processing Software

- Database Management Software

- ERP Software

- Educational Software

- Medical and Healthcare Management Software

- Logistic Management Software

- CRM Software

- Video Games and Game Creation Software

- And More

Maximizing your opportunity for success

Software companies typically have heavy R&D activity. However, there are some limitations based on software use, contract terms and IP rights.

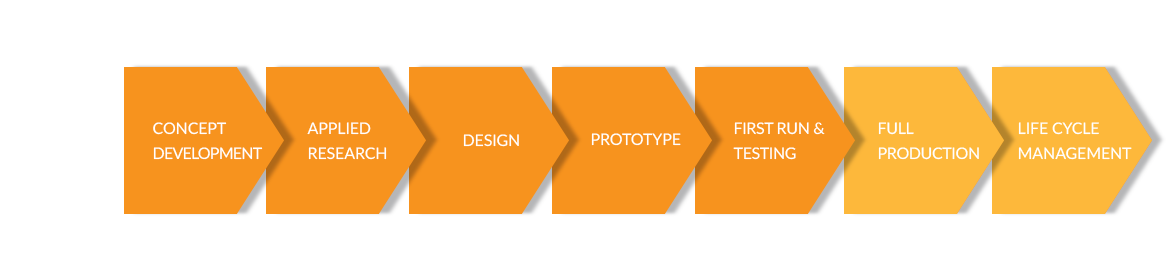

EXAMPLES OF SOFTWARE ACTIVITIES INCLUDE

- Design of software architectures

- Database design

- Regression and unit testing

- Concept development and ideation

- Development of specifications and requirements

- Alpha and beta prototype development and testing

- Developing test cases for functionality and performance analysis

R&D TAX CREDITS IN THE SOFTWARE INDUSTRY

A wide range of roles within a software company contribute to R&D activities, such as software programmers, software analysts, QA testers and support team members.

Software

The software industry’s inherent reliance on innovation and experimentation makes it a clear beneficiary of the research and development tax credit. Many software developers can recover cash simply based on their daily activities, due to the technological nature of programming.

Client A

- Employees: 27

- Revenue: $4,292,000

- Total Credit: $247,000 **

Client B

- Employees: 150

- Revenue: $10,000,000

- Total Credit: $447,000 *

Client C

- Employees: 526

- Revenue: $71,392,400

- Total Credit: $1,092,000 **

Federal Only (*) or Federal & State (**)

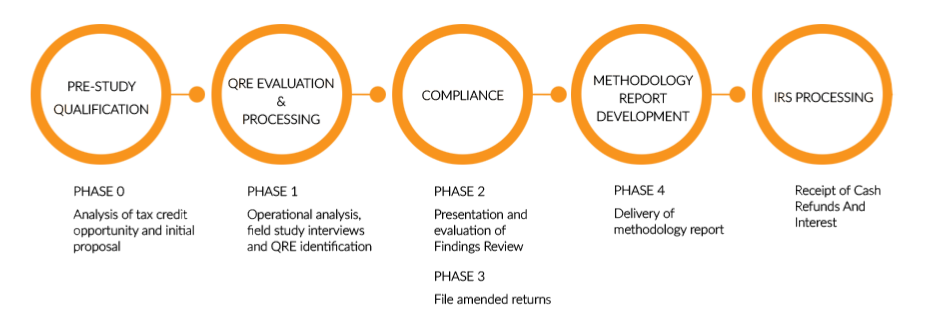

THE APEX ADVISORS R&D TAX CREDIT PROCESS

From study to processing

We utilize a comprehensive process that ensures all possible R&D activities are considered and calculated with accuracy. The Preliminary Assessment is provided to companies at no cost. The estimated duration of all phases is 2 to 3 months.