NEW MARKETS TAX CREDIT (NMTC)

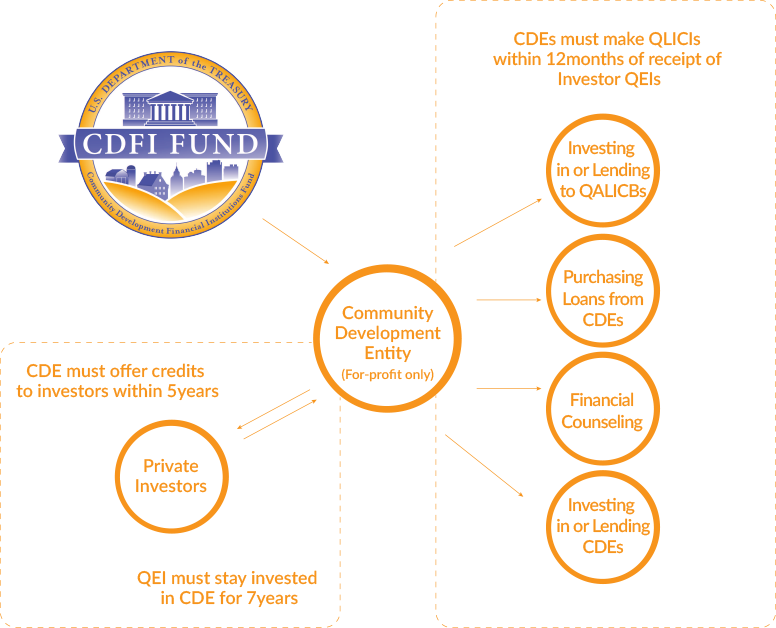

The New Markets Tax Credit (NMTC) incentivizes community development and economic growth by attracting investment to distressed communities. Individual and corporate investors who make Qualified Equity Investments (QEIs) in specialized financial intermediaries called Community Development Entities (CDEs) are able to receive a tax credit against their federal income tax. CDEs, in turn, use the proceeds of these QEIs to make Qualified Low-Income Community Investments (QLICIs), such as business loans, in low-income communities.

THE VALUE OF NMTC

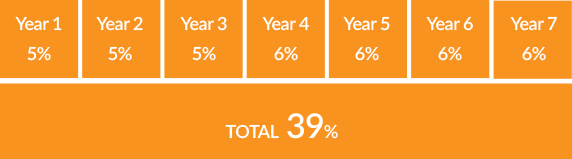

The NMTC is taken over a 7-year period, and is equal to 39% of the original amount invested in the CDE. The credit rate is 5% of the original investment amount in each of the first three years, and 6% of the original investment amount in each of the final four years.

Examples of Benefits

- The CDFI Fund awards a tax credit allocation of $10 million to a CDE.

- The CDE offers the tax credit to a single investor in exchange for a $10 million equity investment.

- Generates a $500,000 credit annually for the first three years;

- Generates a $600,000 credit annually for the final four years.

- Total credit value over 7 years is $3,900,000

NMTC PROCESS

WHAT IS A LOW-INCOME COMMUNITY?

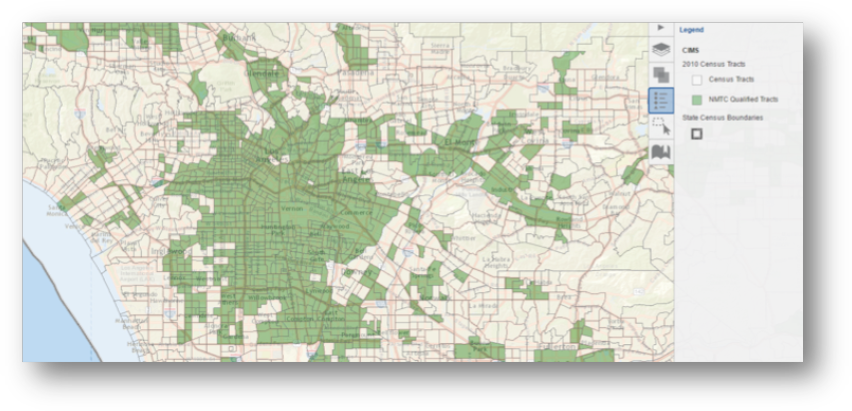

The NMTC Program provides an incentive for investment in “Low-Income Communities” (LICs):

- Where the poverty rate is at least 20%; or

- Where the median family income does not exceed 80% of the area median family income; or

- Where the median family income does not exceed 85% of the area median family income provided the census tract is located in a high migration rural county; or

- Where the census tract has a population of less than 2,000 and is contained within a Federally designated Empowerment Zone and is contiguous to at least one other LIC.

*Map shows LICs in the Los Angeles area. Find LICs near you.