After health care reform, next in line on the White House’s legislative agenda is tax reform. And according to President Trump, “after health care, taxes are gonna be so easy.” Yet, with the struggle to find common ground among policymakers on nearly every issue, it is likely that passing tax reform will be more complicated, more controversial, and more drawn-out than expected. Despite the uncertainty regarding future tax reforms, one tax incentive is here to stay, appearing on both President Trump’s and Republican lawmakers’ proposals– the federal R&D Tax Credit. Unarguably, this tax incentive has proven indispensable, implemented in 1981 and extended 16 times until made permanent by President Obama in 2015. And deservedly so– the incentive provides businesses with over $12 billion in tax credits each year.

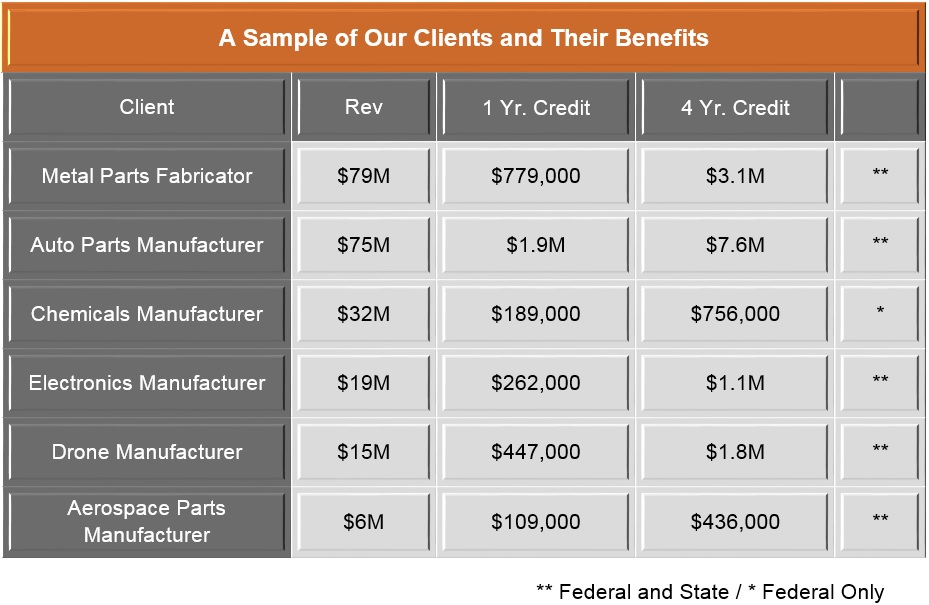

So how lucrative is this tax credit to the average taxpayer? Below, we aim to provide you with a better understanding of how effective and how significant the R&D Tax Credit can be to businesses in manufacturing, with real-world examples featuring our own clients and their benefits in dollar amounts. Find out how much you can benefit from the R&D Tax Credit.

INDUSTRY SNAPSHOT: MANUFACTURING

Manufacturers are prime candidates for the R&D Tax Credit due to their everyday activities that fit the IRS’s definition of “R&D.” In fact, due to the popularity of this credit among manufacturers, it has been dubbed “the manufacturer’s credit.” If your business performs any of the following activities, you are eligible for the R&D Tax Credit:

- Developing new or improved products, processes, or formulas

- Designing tools, jigs, molds, and dies

- Developing prototypes, models, samples

- Improving product quality and/or yields

- Developing, implementing, or upgrading systems and/or software

- Performing alternative material testing

- Testing new concepts and technology

- Developing patents

- Performing environmental testing

A Sample of Our Clients and Their Benefits

Federal R&D tax credits can be claimed retroactively for up to 3 years, and 36 states provide an additional state R&D credit, resulting in a much larger benefit.

We work with manufacturers throughout the country to provide them with highly specialized tax credit services, including the R&D Tax Credit. If you are a manufacturer, the R&D Tax Credit is one tax credit that should not be overlooked. Manufacturers in all industries are eligible and can generate significant tax savings that may prove crucial in times of economic uncertainty.

For further information or a complimentary assessment of your eligibility and potential credit size, contact us today.