As the second quarter of 2021 quickly approaches, many businesses are looking for a means to obtain the necessary revenue to recover from any downturn or lock-down. From manufacturing to restaurants, hospitality to retail, many businesses have been impacted by shut-downs or lost revenue. Now that businesses are starting to return to some sense of normal operations, employers have to find a way to make improvements, and cover payroll, but may suffer from depleted financial reserves. The Employee Retention Credit can be that solution.

When enacted on March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) contained provisions to aid businesses through a time of crisis. Some provisions of note were the Paycheck Protection Program (PPP) loan, as well as the Employee Retention Credit. Although these programs were helpful, there were restrictions that prevented them from reaching their full potential. One of the main weaknesses of the CARES Act was that taking a PPP loan precluded a business from applying for the Employee Retention Credit.

As 2020 proceeded, major deficiencies in the CARES Act were realized, so Congress took further steps to enhance the provisions of the act. On December 27, 2020, the Taxpayer Certainty and Disaster Tax Relief Act (Relief Act) was enacted into law. Major achievements of the Relief Act were that it provided for the full forgiveness of PPP loans, it also retroactively allowed businesses who had claimed a PPP loan to apply for the Employee Retention Credit from the passage date of the CARES Act, if they qualified, and it extended the Employee Retention Credit eligibility dates until June 30, 2021.

When enacted on March 11, 2021, the American Rescue Plan Act of 2021 further extended the Employee Retention Credit until December 31, 2021, and it codified the credit into Section 3134 of the Internal Revenue Code.

The Employee Retention Credit has turned out to be one of the best kept secrets of 2021. The credit specifically rewards a company for keeping employees on the payroll. The credit not only provides a reduction of payroll taxes, but also permits any unused credit to be refunded to the taxpayer.

How does a company qualify?

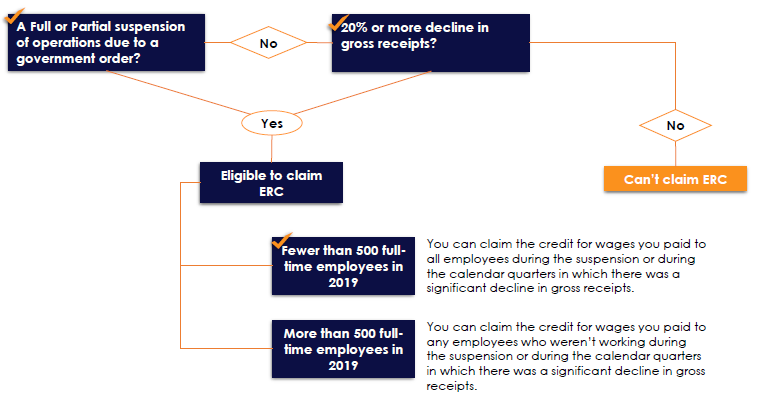

There are two thresholds allowed for determining eligibility. The first threshold requires looking at gross receipts for each quarter of 2019 and comparing against the same quarter in 2020 or 2021. The second threshold provides for credit eligibility if, during the respective quarters of 2020 or 2021, there was a full or partial suspension of operations due to a government order. If a company qualifies for the first and second threshold requirements, the company will not receive double benefits, but shall only be permitted to receive the same amount of benefit permitted if only one threshold had been met.

Once either of the two above thresholds is met, a company may be eligible for the following benefits against payroll taxes, with unused portions being refundable:

- 2020: If a company has a 50% decline in gross receipts, compared to the same quarter of 2019, that company may be entitled to $5,000 per eligible employee. The second method provides, if a company experienced a suspension of operations, it may be entitled to $5,000 for each eligible employee paid during the suspension in 2020.

- 2021: If a company has a 20% decline in gross receipts, compared to the same quarter of 2019, that company may be entitled to $7,000 per quarter for each eligible employee. The second method provides, if a company experienced a suspension of operations, it may be entitled to up to $7,000 for each eligible employee paid during a suspension of operations in each quarter of 2021.

Like many parts of the tax code, there are different aspects of the Employee Retention Credit that make it difficult for most taxpayers to calculate. Although the PPP and Employee Retention Credit can be combined, there are limitations when the two programs are combined. Specifically, expenses used for Payroll Protection Program forgiveness cannot be included in the calculation of the Employee Retention Credit. Additionally, the wage expenses included in a Research and Development Tax Credit must also be removed from a calculation. Since there are significant amounts of data sets that go into the calculation, the analysis can be daunting to anyone who does not customarily perform these types of analyses.

Due to the complications listed above, many companies are turning to experts in specialty tax services to calculate and defend the Employee Retention Credit. Specialty tax firms, like Apex Advisors, have teams of individuals dedicated to data analysis, data calculation, and attorneys familiar with the nuances of these very specific tax codes.

Apex utilizes 20 years of experience, and a team of professionals that includes attorneys and CPAs, as well as professionals who have experience working at the IRS as agents and attorneys. Apex’s studies involve a thorough review of all data points and include audit defense for every service when applicable.

It must be noted, this article is intended to be brief; therefore, it is not all encompassing. To discuss the topic in more detail, or to discuss other related topics, please call the offices of Apex Advisors, or David Porada directly at 248.259.7421.