The Top 3 Industries for Claiming the R&D Tax Credit

Following up on our previous post regarding applicable industries and real-life client benefits, in today’s post, we’ve put together a brief summary featuring the top 3 industries in which the R&D Tax Credit really demonstrates its worth: Manufacturing, Software/Technology, and Design-Build.

Since becoming a permanent provision in the IRS tax code, and with its recent changes targeted to benefit small businesses, the R&D Tax Credit is gaining popularity among companies of all sizes and industries. With the R&D Tax Credit valued at over $12 billion a year, companies not taking the credit may be losing out on a lucrative opportunity and risking their competitive edge in the marketplace. If your company falls into any of the following industries, the R&D Tax Credit will be a significant tax-saving tool and should be part of your financial planning for future tax years.

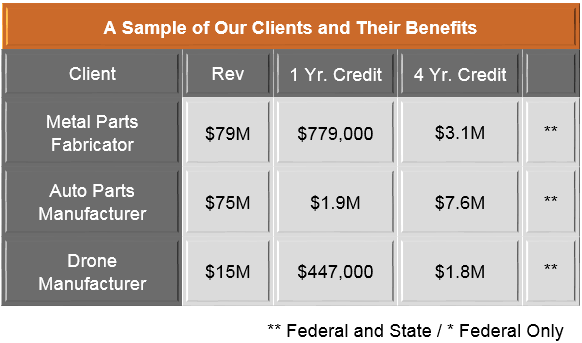

INDUSTRY SNAPSHOT: MANUFACTURING

Manufacturers are prime candidates for the R&D Tax Credit due to their everyday activities that fit the IRS’s definition of “R&D.” In fact, due to the popularity of this credit among manufacturers, it has been dubbed “the manufacturer’s credit.” If your business performs any of the following activities, you are eligible for the R&D Tax Credit:

- Developing new or improved products, processes, or formulas

- Designing tools, jigs, molds, and dies

- Developing prototypes, models, samples

- Improving product quality and/or yields

- Developing, implementing, or upgrading systems and/or software

- Performing alternative material testing

- Testing new concepts and technology

- Developing patents

- Performing environmental testing

A Sample of Our Clients and Their Benefits

Federal R&D tax credits can be claimed retroactively for up to 3 years, and 36 states provide an additional state R&D credit, resulting in a much larger benefit.

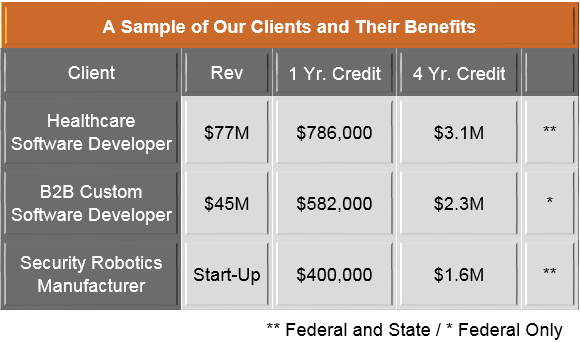

INDUSTRY SNAPSHOT: SOFTWARE/TECHNOLOGY

Software developers and other tech companies have a unique advantage when claiming the R&D Tax Credit—because of the highly technical nature of their work, companies in these industries are often able to generate three times as much credit as companies in other industries, relative to their size. As a result, even a small firm can generate hundreds of thousands of dollars in tax credits. Now, with the recent legislative changes, qualified startups can also apply their R&D credits to their payroll tax liability—a powerful tool that could determine the success of a new business. If your business performs any of the following activities, you are eligible for the R&D Tax Credit:

- Developing new or improved technologies

- Designing and developing the structural software architecture

- Establishing electronic interfaces and functional relationships between various software modules

- Programming software source code

- Conducting unit, integration, functional, performance, and regression testing

A Sample of Our Clients and Their Benefits

Federal R&D tax credits can be claimed retroactively for up to 3 years, and 36 states provide an additional state R&D credit, resulting in a much larger benefit.

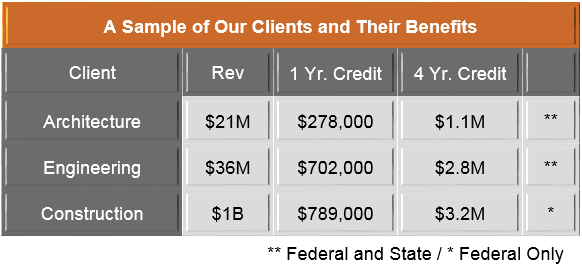

INDUSTRY SNAPSHOT: DESIGN-BUILD (A/E/C)

The Design-Build industries, including Architecture, Engineering, and Construction, are often overlooked as areas for the R&D credit because identifying their qualified research activities is generally more difficult than in typical R&D-intensive industries. However, firms in these industries perform qualified R&D activities on a regular basis, which can amount to a considerable credit size. Architecture and Engineering firms particularly benefit from a majority of their employees having a direct role in R&D-eligible activities. If your business performs any of the following activities, you are eligible for the R&D Tax Credit:

- Designing structures, real estate developments, master plans

- Developing planning and elevation drawings

- Designing LEED/green initiatives

- Utilizing Building Information Modeling (BIM) for sub-system coordination

- Analyzing the functions of a design directed at improving performance, reliability, quality, safety, and/or life cycle costs

A Sample of Our Clients and Their Benefits

Federal R&D tax credits can be claimed retroactively for up to 3 years, and 36 states provide an additional state R&D credit, resulting in a much larger benefit.

We work with businesses throughout the country to provide them with highly specialized tax credit services, including the R&D Tax Credit. If you are involved in any of the above industries, the R&D Tax Credit is one tax credit that should not be overlooked. Companies of all sizes are eligible and can generate significant tax savings that may prove crucial in times of economic uncertainty.

For further information or a complimentary assessment of your eligibility and potential credit size, contact us today.